Kenji Yamaguchi1, Yukari Shirota2* 1 Science & Education Center, Ochanomizu University, Tokyo, Japan

2 Faculty of Economics, Gakushuin University, Tokyo, Japan

Download Citation:

|

Download PDF

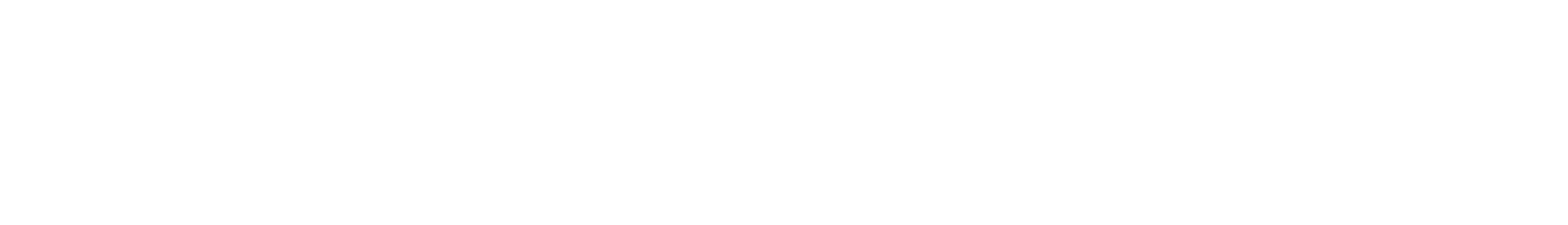

The address by President Trump on the trade between US and China in May, 2019 had a significant and global influence on manufacturing companies. In this paper, we extracted the stock price decline patterns due to the address by using Singular Value Decomposition Method with the intention of introducing a new approach to measure patterns of effects of such contingencies which happen once in a while on stock prices. The results are expected to have also meaningfulness for investors as well as analysts. Our analyses include two types. The first analysis focuses on the extraction of patterns among companies which have high intensity of business engagement in China and the second one among counties. In the first analysis we used only Japanese companies’ data because of data availability. As to the second analysis, we used only machinery industry’s data of Germany, Japan and US which compete in the global market and have mature stock markets respectively. The analyses made differences of patterns among businesses such as B-to-B and B-to-C stand out in the first analysis and differences among countries in the second analysis. Those results are expected to inspire further research, especially, exploration of new methodologies in the area of analysis of stock price fluctuations due to economic crises such as global trade or political affairs.ABSTRACT

Keywords:

Disastrous impact on stock prices, US-China trade friction, Singular value composition.

Share this article with your colleagues

REFERENCES

ARTICLE INFORMATION

Received:

2020-03-29

Revised:

2020-09-12

Accepted:

2020-10-17

Available Online:

2020-12-01

Yamaguchi, K., Shirota, Y. 2020. Impacts of US-China trade friction on stock prices: An empirical study of machinery companies. International Journal of Applied Science and Engineering, 17, 383–391. https://doi.org/10.6703/IJASE.202012_17(4).383

Cite this article:

Copyright The Author(s). This is an open access article distributed under the terms of the Creative Commons Attribution License (CC BY 4.0), which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are cited.